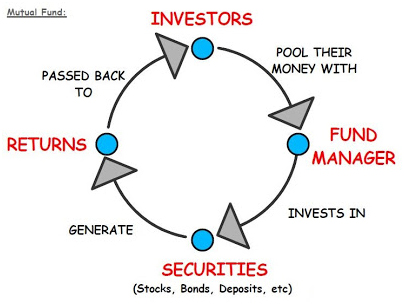

What is a Mutual Fund?

A Mutual Fund is an investment company that pools the funds of many individual and institutional investors to form a massive asset base. These assets are then entrusted to a professional fund manager who develops and maintains a diversified portfolio of security investments. People who buy units of a mutual fund are its investors. Their purchases provide the money for a mutual fund to buy securities such as stocks and bonds. A mutual fund can make money from its securities investments in two ways: a security can pay dividends and interest to the fund, or a security can rise in value. The fund passes any dividends, interest or profits on the sale of its portfolio securities, less fund expenses, to investors in the NAV

Basic Types of Mutual Funds:

Mutual funds are classified into five main categories:

1. Equity Funds

Equity Funds are mutual funds that focus on investing money in the stocks of companies from various industries.

2. Debt Fund

If a mutual fund is a debt fund, a significant portion of the fund is invested in government and/or corporate bond securities.

3. Balanced funds

In a balance fund, money is invested in stocks across market capitalisation bands as well as in bonds. An ideal balanced fund is a fund that has ~65% money invested in stocks and ~35% money invested in debt securities like government and corporate bonds.

4. Asset- allocation funds

Asset -allocation mutual funds make investments in stocks and bonds which are dynamically managed by using hedging and arbitrage strategies. These funds are more flexible and try to shift their investments to maximize returns from stocks as well as bonds, based on the status of the market.

5. Money Market Fund

In an money market fund, a major portion of the fund is invested in short-term money market instruments.

Why Mutual funds?

Mutual funds can help in mitigating investment risks and optimising returns, especially to people who do not have the means or inclination to analyze financial instruments and strategies. Mutual funds are expected to protect and grow money entrusted to them by small investors.

Advantages of Investing in Mutual Funds:

Professional Management

Mutual fund investments are managed by expert fund managers. Mutual fund managers are adept at analyzing various investment products available in the market. This training and expertise enables them to select instruments which would yield the best possible returns to the fund and its investors. Mutual fund managersare also supported by research teams focused on acquiring the best opportunities in the market.

Convenience

You can invest in mutual funds online or vide bank cheques and also can set up automatic investments and withdrawals.

Investors can start investing as low as Rs. 5,000 and minimum additional investments of Rs.1,000.

Less risk through diversification

Since mutual funds are a collective poo of funds from various investors, this strategy provides mutual fund investors instant diversification over a wide array of securities. Mutual fund managers invest in multiple financial instruments so as to avoid the concentrated risks associated with investing in a single financial security. This is done to reduce the risk posed by occasional and unexpected low performance of some securities by others that yield good returns.

Easy Liquidity

Liquidity is the ability to easily convert investments into cash. Mutual fund investments are very liquid because the mutual fund company stands ready to buy back the shares of the mutual fund to be redeemed by the investor based on the current NAV. The redeemed amount is also credited to the investor within 3 business days. This easy access to invested funds (also known as ‘liquidity’ in financial parlance) is a strong advantage of mutual funds, for all investors.

Safety

The mutual fund industry is highly regulated by the Securities and Exchange board of India (SEBI) under the SEBI Act (Year??). Every mutual fund company is required to submit regular reports to the SEBI as well as to the shareholders. Moreover, a mutual fund's assets are held by custodians separate from the management company.

Potential Higher Returns

Investments in a mutual fund can potentially give an investor higher returns, compared to a traditional,banking investment products.

Tax Efficient

Earnings from Mutual Fund investments are taxed as dividends or capital gains which are tax efficient.

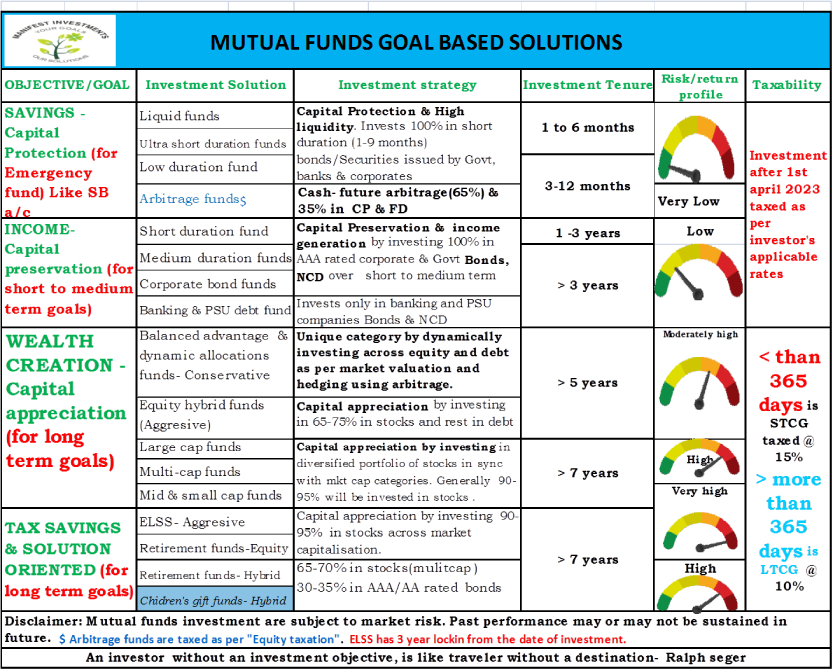

Mutual fund types based on your objectives

Principles of Building a Portfolio

A portfolio of investments should be diverse, have multiple options and should be tailored to achieve your financial goals, step-by-step. One of world’s wealthiest men, Mr. Warren Buffet has declared, “I don't look to jump over seven-foot bars; I look around for (many) one-foot bars that I can step over.”

A portfolio to fit your investment goals can be created with a variety of products or funds such as those in the chart above. It is important to begin by establishing a plan and determining whether your goal is to build wealth over time, generate income or generate money for specific objectives like buying a home. You may consider having different portfolios for different goals and manage them to generate the right amount of money at the right time.