You would have probably be familiar with Maslow’s Hierarchy of Needs, if you've studied psychology, or more likely, marketing as part of your business school curricula. This hierarchy was formulated by Abraham Maslow to classify and understand levels of needs that human beings have. Starting from the most basic level, these roughly correspond to physiological needs, safety, social needs and, at the top of the hierarchy, what he called, and self-actualization. According to Maslow, needs at a higher level become important only when those at the lower level are met. Someone who does not have enough to eat or whose basic physical safety is not assured is unlikely to worry too much about the deeper meaning of his or her life.

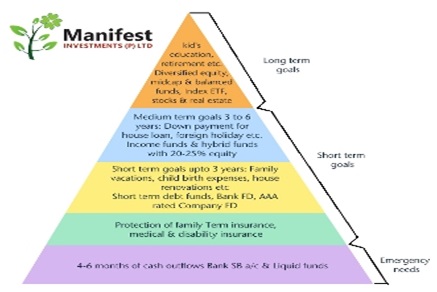

It is interesting to see that this idea of hierarchy of needs can be useful in planning one’s savings and investments. There are types of investments that belong at a higher level of a ‘Hierarchy of Savings’ and shouldn’t be attempted before the lower levels are taken care of.

Here’s what we call as ‘Hierarchy of Savings’.

SAVING MONEY IS HALF THE BATTLE; THE OTHER HALF IS PRIORTIZING HOW TO USE THAT MONEY.

Level 1- Basic contingency funds: You need to keep 4 to 6 months of household expenses+emis in cash – just in case. Put 1/3 rd money in bank savings a/c and 2/3rd in Liquid funds which gives higher return than SB a/c. That way you don't have to reach for credit card when they are short term emergencies.

RECOMMEDATION: SB A/C & Liquid & ultra short term funds

Level 2- Term Insurance: A realistic amount that should be calculated to allow your dependents to maintain the standard of living, finance long to medium-term life goals and repay liabilities if you were to drop dead, be struck with a debilitating injury or disease. The Thumb rule is 9-10 times of take-home salary plus outstanding liabilities. Or Use HUMAN LIFE VALUE to know your life insurance needs. Human capital is the biggest asset, but we tend to neglect it.

RECOMMEDATION: Term insurance with Accident & disability riders

Level 3: Savings for Foreseeable Short-Term Goals: Money that is needed for expenses that are planned to be made within the next two to three years, like House renovation, Vacations, etc. Almost all of this should be in minimal risk type savings instruments.

RECOMMEDATION: Short term debt funds, Bank FD, AAA rated corporate FD and Non convertible debentures.

Level 4: Savings for foreseeable Medium-Term Goals: Money that is needed for meeting goals within 3-5 years. Basically these are goals which will help you to achieve long term goals. EG: Down payment for housing loan, Vacations, buying a car etc..

RECOMMEDATION: Medium duration & corporate bonds funds and conservative hybrid funds with 20 to 25% allocation to equities.

Level 5 : Savings for long-term foreseeable goals. Same as level 4, except the planned expenses are beyond 7 years away, like Kids’ Education, Retirement, Capital needed for starting own business etc. Inflation is the biggest spoiler when it comes to long term goals. Hence at this level one should be investing in equity-oriented investments. Of course depending on investors Risk appetite.

RECOMMEDATION: Diversified equity funds, mid cap funds, balanced funds, Index ETFs & stocks in sync with individual risk tolerance and time horixon.

One could think of many other levels beyond this and really, the details matter much less than the concept. Also, depending on one’s circumstances, any of the levels may have to be modified. However, this is not an asset allocation tool. The point of this exercise is to prevent you from going to higher level unless the lower one is fulfilled. it’s simply a way of reinforcing that there’s little point in trying to fine-tune how much you will earn in an equity investment if you haven’t put away cash for an immediate emergency or adequate term insurance cover.